CMA Data means Credit Monitoring Arrangement data. As per RBI guidelines, CMA data is required for Project Loans, Term Loans and Working Capital Limits. This data is to be provided by a company to bank for getting the loan from bank and every year, for renewing or enhancing their existing Bank loan. CMA Data is a systematic analysis of working capital management of the borrower and the purpose of this statement is to ensure the use of funds effectively.

CMA data generally include 2 years Audited Financials and 3 future years Financial Projection of company, Fund flow statement, Changes in Working Capital report, Ratio analysis and Maximum Permissible Bank Finance (MPBF) report.

The banks rely very much on this report and carefully evaluate CMA data for eligibility of funding. Our experts help to highlight the potential of your business in CMA data to be submitted to the bankers at the time of sanction and renewal.

It basically contains 7 statements which help Banker to understand the financial health of the company:

1. Particulars about the present limit and the proposed limit. It will show both Fund and Non-fund based limits of the borrower and usage limit or current balance.2. Operating Statement/Profit and loss account statement, bank will know performance of company. It also helpful to know earning cycle for paying the expenses.

3. Balance sheet, bank will know the financial position. Is it sound or not? Do company has own assets or all assets on debt. So, to study balance sheet is must. CMA Data will have 2 years Audited balance sheet and 3 years projected balance sheet. So, analyst can make comparative balance sheet for knowing the changes in the balance sheet’s position.

4. With fund flow statement, bank can know the flow of fund. Is company wasting their fund or applying fund for growing.

5. Changes in working capital report – helps to understand the changes in current assets and current liabilities. It will also helpful to know short term solvency of company. If it has enough money to pay current liabilities, it cannot misuse its long term resources.

6. With ratio analysis, bank will understand the position of company more clearly within few minutes.

7. Banks ask the maximum permissible bank finance (MPBF) working. That is – The amount company is looking out for borrowing from bank? It should not more than 75% of working capital or 20% of Sales.

DOCUMENTS/INFORMATION REQUIRED TO PREPARE CMA:

1. Past 2 years Audited Financials

2. Provisional Financial for the current year; in the absence of provisional financials, details of the top line shall be essential

3. Latest Sanction letter (in case of renewal)

4. Term Loan Repayment Schedule, if any

5. Details of proposed enhancement (if any) along with the terms and conditions

Browse and download a wide variety of award-winning video, audio, business, utility, or graphics software programs for both PC and Mac.

free download. software For Cma Data Preparation Download

- Pdf and note - free Download CA, CS, ICWA, CMA free note and pdf online only at cakart.in -The Largest CA, CS, ICWA, CMA Exams note and pdf store -Huge collection of study material, notes, video lectures, audio lectures, podcasts, ebooks, tests, mock test papers, practice test papers, Revision test papers, RTP, Question papers, Suggested Answers, ICAI cloud campus,BoS knowledge Portal,ICSI.

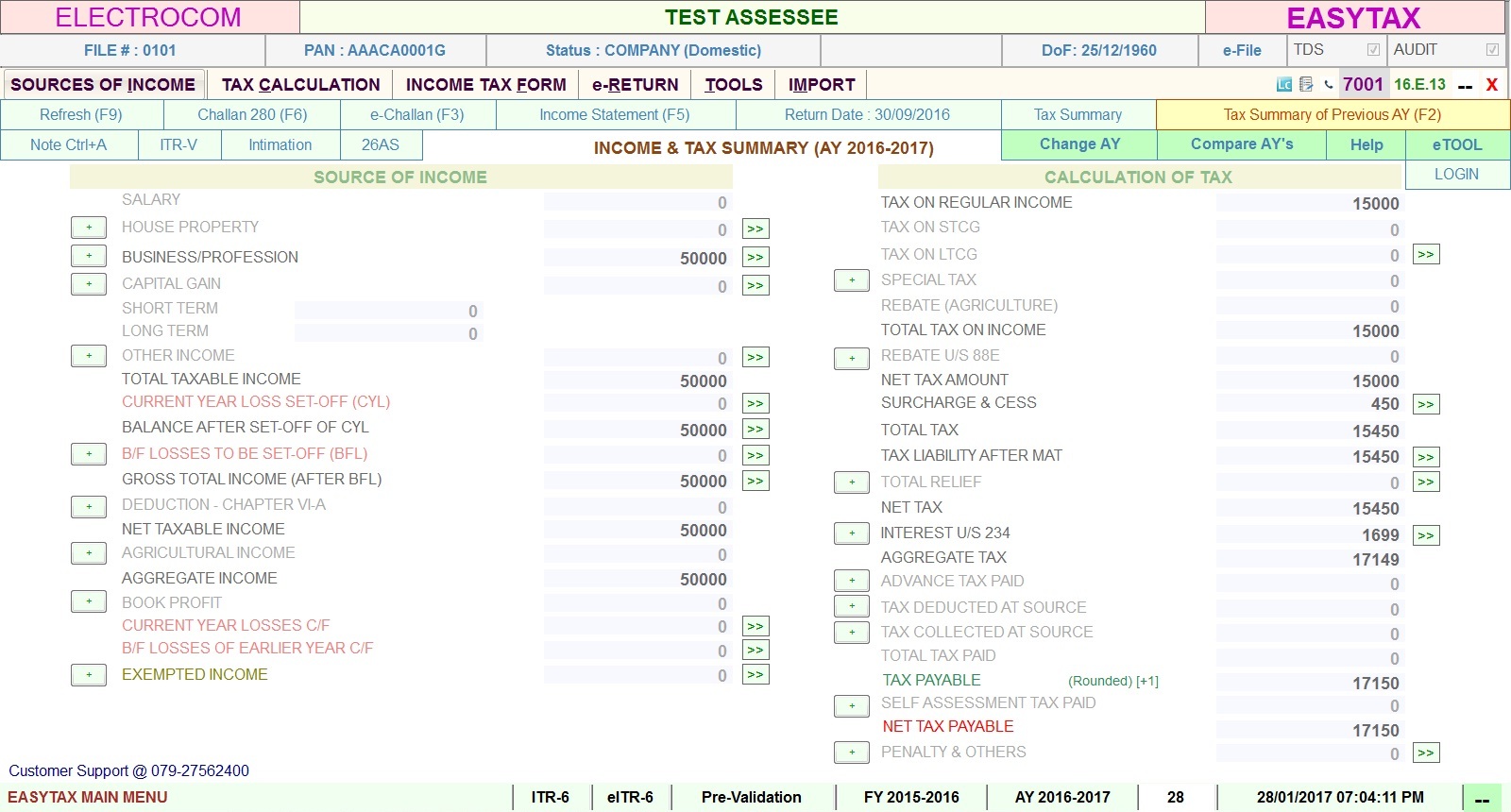

- Gen CMA/EMI - The CMA Software in India. Pdf ppt calc faq utility. Buy Now Download Free Trial. Email Trusted by More Than 40,000 Clients Across India. Features of Gen CMA/EMI Software. Multiple Years Projections. Preparation of CMA Data for as Many Years as.